2025 Investment Retro: On Strategic Detachment

After the April 2 tariff announcement — which inspired my earlier post, Tariff Shocks and Portfolio Lessons: Navigating Uncertainty in a Volatile Market — I closely monitored my portfolio and the development of the markets for several weeks, trying to make sense of what was unfolding.

At some point, I realised that this constant monitoring was taking up too much mental space and beginning to interfere with my peace. What initially felt like diligence slowly turned into noise. I decided to step back, stop watching, stop reacting, and turn my attention toward other projects instead.

I only revisited the situation months later, at the end of the year, in preparation for my tax return. By then, my portfolio had not only recovered from the tariff-induced volatility, but exceeded its pre-tariff value. Seeing that outcome after a long period of deliberate detachment felt more revealing than any day-to-day update.

LOOKING BACK AT APRIL WITH DISTANCE

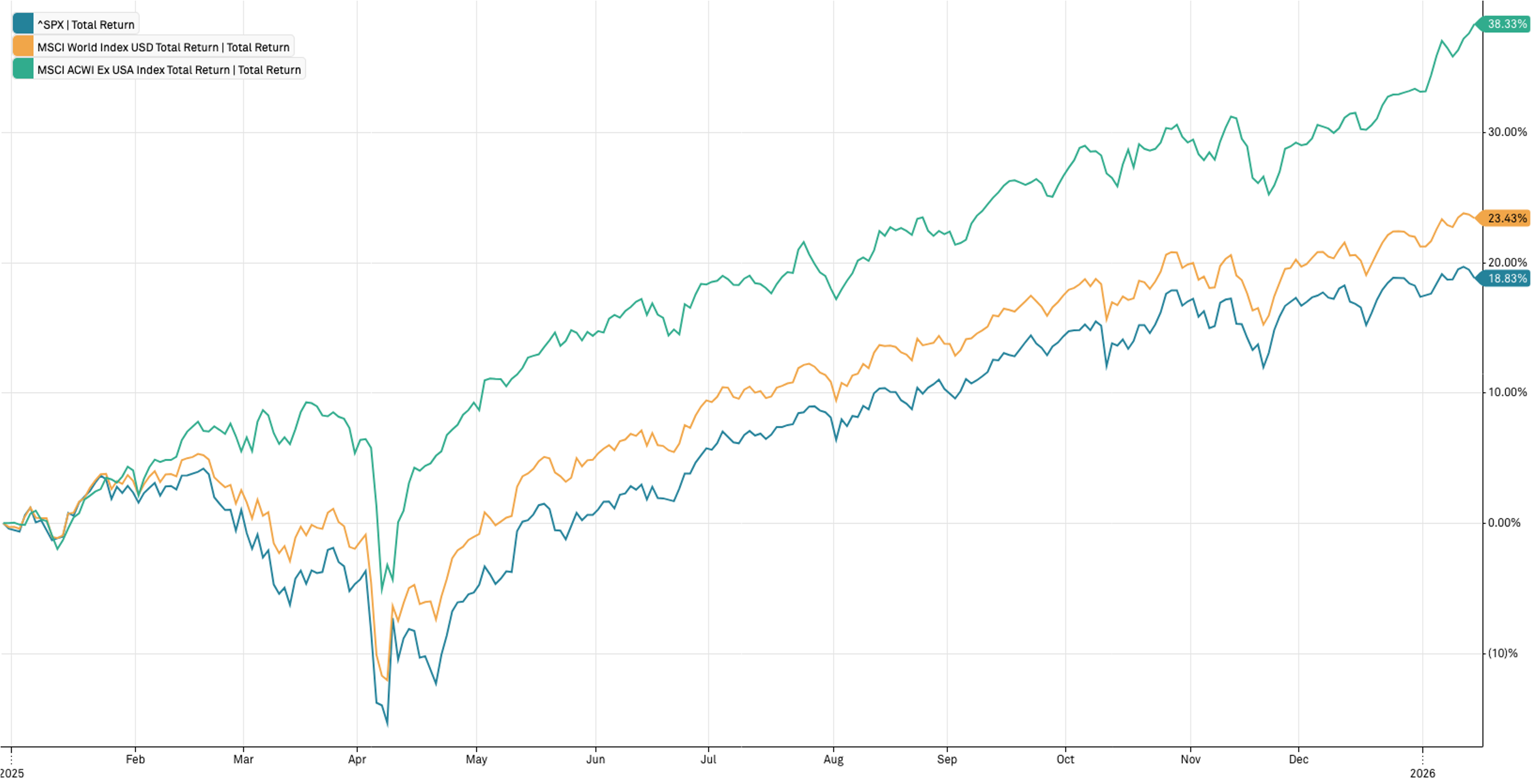

With some time having passed, I was curious about how a few of the observations I made in April had played out. At the time, equities outside the U.S. appeared to be less affected by the surge in geopolitical and economic uncertainty. This initially felt tentative, but a full year of data lends it more weight and makes the case for global diversification harder to ignore, particularly in the current climate.

The divergence between U.S. and world stocks persisted as the year progressed. The MSCI ACWI ex USA Index, which tracks developed and emerging market equities outside the United States, delivered a total return of roughly 38% in euro terms as of mid-January 2026. Over the same period, the MSCI World Index returned around 23%, while the S&P 500 lagged further behind at approximately 19%.

Total return (EUR) of S&P 500, MSCI World, and MSCI ACWI ex USA from January 2025 through January 15, 2026. Source: S&P Capital IQ.

What I find striking is not the absolute performance, but the relative behaviour. Periods of political uncertainty tend to reveal differences in geographic exposure that are less visible in more favourable conditions. In my case, not making changes — simply allowing existing diversification to work — was sufficient. For portfolios built with a long-term horizon, this reinforced my sense that rebalancing once or twice a year is often enough, and that frequent adjustment tends to be a response to discomfort than to necessity.

ACTING WITHOUT URGENCY

In my April post, I noted that investors seemed to be struggling to find safe havens amid the unusual combination of falling equities, falling bonds, and a weakening U.S. dollar. What I did not fully register at the time was how clearly gold was already fulfilling that role.

Gold’s rally had started earlier, in 2024, but it accelerated substantially throughout 2025. By the end of the year, gold had appreciated by roughly 65–70%, positively outperforming many assets that attract far more attention. I did not participate in that move, and realised that this may have been more than a simple omission.

Perhaps my own bias played a role here. I have always been sceptical of physical assets: their lower liquidity, the practical inconveniences, and — in my case — the friction they introduce into a mobile lifestyle. That bias likely prevented me from fully acknowledging gold’s role, not as a speculative asset, but as a store of confidence when institutional trust weakens. Over the past two years, gold has been doing exactly what it historically does — quietly, persistently, and without needing narratives.

When I reviewed my portfolio in December, I did make a few deliberate changes. I exited three positions that ended the year in negative territory and where my confidence in a meaningful recovery was low. These included a mid-cap ETF that continued to struggle in a volatile, high-rate environment, a financial stock where the risk-reward balance no longer appealed to me, and a biotech position that was about to be acquired below my break-even price, with any remaining upside limited to contingent value rights that did not materially alter the outcome.

These were not reactions to the April turbulence and accepting those losses had a practical dimension, allowing me to offset gains from dividends and ETFs. More importantly, it freed both capital and attention. Not every position deserves patience, and not every loss deserves resistance.

STRATEGIC INACTIVITY AND DETACHMENT

For someone inclined toward action, idleness or detachment can feel uncomfortably close to renunciation. Over time, I have come to see it differently. I have experienced this not only in relation to markets, but also in situations where external pressure encourages action that ultimately serves someone else’s interests more than my own.

Knowing when to act and when to step away can be critical, and timing matters. Detachment is most effective when it follows sufficient understanding — when the situation has been examined from sufficient angles that, across most plausible scenarios, disengagement still appears to be the better option. There may always be low-probability outcomes where action could make a difference, but when those probabilities are very minor, I accept the risk and let them go.

Often, the most overpowering signal comes afterward. When the decision to step back is followed by relief rather than regret, it tends to confirm that detachment was not avoidance, but clarity. In April, market chaos demanded attention. Refusing to give it permanent residence in my mind preserved something more valuable than short-term certainty: focus, perspective, and freedom.

Featured image: Filtered Perspective — photo by Ana M Pop, Bolzano, September 2025

Disclaimer: This article reflects personal opinions and experiences and does not constitute investment advice. Investing involves risk, including the potential loss of capital. Please consult a licensed financial advisor before making investment decisions.

Leave a Reply